Exploring the realm of revenue-share business models that have proven successful, this guide delves into key characteristics, industries where they excel, and their advantages and disadvantages. Dive in to discover more.

Top revenue-share business models that work

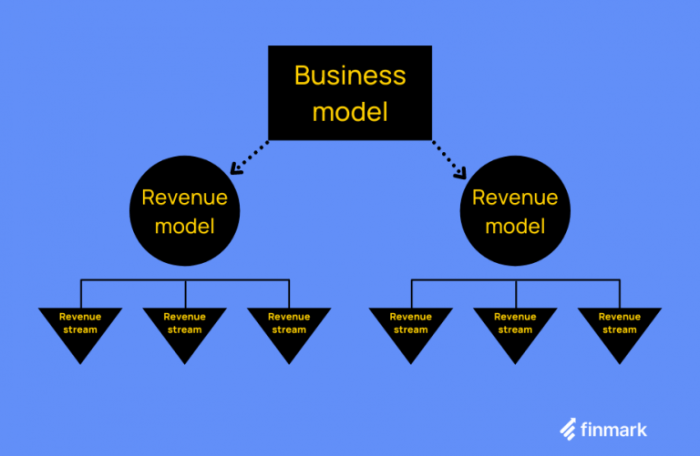

Revenue-share business models have gained popularity due to their ability to create mutually beneficial partnerships between businesses and their partners. Successful revenue-share models typically have the following key characteristics:

- Clear and transparent revenue-sharing terms

- Incentives for both parties to drive performance

- Scalability to accommodate growth

- Regular communication and reporting

Examples of industries where revenue-share models have been effective include:

- Ride-sharing platforms like Uber and Lyft

- Affiliate marketing programs in e-commerce

- Software as a Service (SaaS) providers

When comparing revenue-share models to other business models like subscription or pay-per-use, advantages include:

- Lower upfront costs for partners

- Increased motivation for partners to perform well

- Potential for passive income streams

However, revenue-share models also have some disadvantages, such as:

- Complexity in determining fair revenue splits

- Dependency on partner performance for revenue

- Potential conflicts over attribution and tracking

Factors influencing the success of revenue-share business models

Trust and transparency play a crucial role in the success of revenue-share business models. Establishing trust between parties involved in the revenue-sharing agreement is essential for fostering a long-term partnership. Transparency in communication, financial reporting, and decision-making processes helps build trust and ensures that all parties are aware of their roles and responsibilities.Determining fair revenue-sharing percentages between parties is a key factor in the success of revenue-share business models.

It is important to consider the value each party brings to the partnership, the risks involved, and the expected outcomes. Fair revenue-sharing percentages should be based on a clear understanding of the contributions of each party and should align with the overall goals of the partnership.To mitigate risks associated with revenue-sharing agreements, parties can implement various strategies.

One common strategy is to Artikel clear terms and conditions in the agreement, including how revenue will be distributed, how disputes will be resolved, and what happens in the event of unforeseen circumstances. Regular performance monitoring, open communication, and periodic reviews of the revenue-sharing arrangement can help identify and address any potential risks early on.

Example Strategies to Mitigate Risks

- Regular performance monitoring and reporting to track progress and identify any issues.

- Establishing a dispute resolution process to address conflicts and disagreements promptly.

- Including clauses for renegotiation of revenue-sharing percentages based on performance or changing circumstances.

- Implementing strong data security measures to protect sensitive information shared between parties.

Implementing revenue-share models

When it comes to setting up a revenue-share agreement, there are several key steps that need to be followed to ensure a successful partnership.

Steps in setting up a revenue-share agreement

- Define the terms: Clearly Artikel the terms of the agreement including revenue split, payment schedule, and duration.

- Identify partners: Choose trustworthy and reliable partners who are aligned with your business goals.

- Create a contract: Draft a legal agreement that includes all the terms and conditions of the revenue-sharing partnership.

- Track performance: Implement a system to track and monitor revenue generated to ensure accurate distribution.

- Regular communication: Maintain open communication with partners to address any issues or concerns that may arise.

Importance of clear communication and documentation

Clear communication and documentation are essential in revenue-sharing partnerships to avoid misunderstandings and conflicts.

- Prevents disputes: Having clear communication channels and documented agreements helps in resolving any disagreements that may arise.

- Builds trust: Transparent communication and documentation build trust between partners and foster a strong working relationship.

- Legal protection: Proper documentation provides legal protection in case of any disputes or breaches of the agreement.

Tools and software for revenue-sharing processes

There are various tools and software available that can streamline the revenue-sharing processes and make it more efficient.

- Revenue-sharing platforms: Platforms like PartnerStack and Impact allow businesses to manage and track revenue-sharing partnerships effectively.

- CRM software: Customer Relationship Management software such as Salesforce can help in tracking partner performance and revenue generated.

- Payment processors: Integrating payment processors like PayPal or Stripe can simplify the payment process between partners.

- Analytics tools: Utilizing analytics tools like Google Analytics can provide insights into the performance of revenue-sharing campaigns.

Case studies and best practices

When it comes to revenue-share models, there are several successful companies that have implemented them effectively, as well as key lessons learned from businesses that failed to execute revenue-sharing properly. Here, we will analyze some case studies and provide tips for businesses looking to transition to a revenue-share model.

Successful Companies Implementing Revenue-share Models

One prime example of a successful company implementing a revenue-share model is Airbnb. By allowing hosts to list their properties on the platform and sharing a percentage of the booking fees with them, Airbnb has been able to scale rapidly and create a global network of accommodations.

Another successful case is Uber, which shares a portion of the fare with drivers. This model has incentivized drivers to provide better service, leading to higher customer satisfaction and increased revenue for the company.

Key Lessons Learned from Failed Revenue-sharing Businesses

A cautionary tale comes from Groupon, which initially thrived with its revenue-sharing deals but ultimately faced challenges due to unsustainable discounts and high merchant fees. This led to a decline in customer trust and merchant partnerships, highlighting the importance of balancing revenue-sharing agreements.

Tips for Transitioning to a Revenue-share Model

- Understand your value proposition and how revenue-sharing can enhance it.

- Establish clear and fair revenue-sharing agreements with partners to build trust and long-term relationships.

- Monitor and analyze key metrics to ensure the sustainability and profitability of the revenue-share model.

- Communicate effectively with all stakeholders to align incentives and drive success in revenue-sharing partnerships.

Conclusive Thoughts

In conclusion, the discussion on top revenue-share business models that work sheds light on the intricacies of implementing these models successfully. With insights from case studies and best practices, businesses can navigate this landscape with confidence.

Q&A

How can one identify successful revenue-share business models?

Successful revenue-share models often exhibit clear value propositions, fair profit distribution, and sustainable long-term partnerships.

What are some industries where revenue-share models work effectively?

Industries like software as a service (SaaS), affiliate marketing, and online marketplaces have seen success with revenue-share models.

How can businesses mitigate risks associated with revenue-sharing agreements?

Implementing clear contractual terms, regular performance evaluations, and contingency plans can help businesses mitigate risks in revenue-sharing agreements.