Delving into Share market vs. mutual funds: Which is better in 2025?, this introduction immerses readers in a unique and compelling narrative, with a casual formal language style that is both engaging and thought-provoking from the very first sentence.

As we explore the intricacies of investing in the share market versus mutual funds, we uncover key differences, risks, and potential returns that investors may encounter in the ever-evolving financial landscape of 2025.

Comparison of Share Market and Mutual Funds

When it comes to investing, individuals often find themselves at a crossroads deciding between the share market and mutual funds. Both options offer unique opportunities and risks that investors need to consider before making a decision.

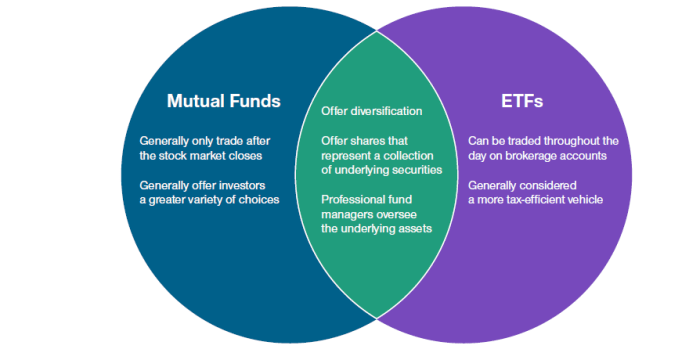

Fundamental Differences

Share market involves buying and selling individual company stocks, allowing investors to directly own a portion of a company. On the other hand, mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities.

Risks Associated

- Share Market: Investors in the share market are exposed to higher volatility and risk due to the direct impact of market fluctuations on individual stock prices.

- Mutual Funds: While mutual funds offer diversification, they are still subject to market risk. Additionally, investors may face fund-specific risks such as manager performance and fees.

Potential Returns

Investing in the share market has the potential to deliver higher returns compared to mutual funds, especially in the long run. However, with higher returns come higher risks, as market volatility can lead to significant losses. Mutual funds, on the other hand, offer a more balanced approach to investing with potentially lower returns but reduced risk through diversification.

Performance Analysis

When analyzing the performance of the share market and mutual funds up to 2025, it is essential to consider various factors that have influenced their performance over the years.

Historical Performance

- The share market has historically shown higher returns compared to mutual funds, but it also comes with higher risks.

- Mutual funds, on the other hand, offer diversified portfolios that aim to reduce risks and provide stable returns over the long term.

- Both share market investments and mutual funds have experienced periods of growth and decline, depending on market conditions and economic factors.

Factors Influencing Performance

- Economic conditions, geopolitical events, interest rates, and company performance are some of the key factors that influence the performance of both share market investments and mutual funds.

- Market sentiment, investor behavior, and regulatory changes can also impact the performance of these investment options.

Volatility Comparison

- The share market is known for its higher volatility, with prices fluctuating rapidly in response to market news and events.

- Mutual funds tend to be less volatile due to their diversified nature, which helps spread risk across various assets.

- In recent years, the share market has experienced increased volatility due to global economic uncertainties, while mutual funds have maintained a more stable performance.

Investment Options and Diversification

Investors in 2025 have a variety of investment options to choose from in both the share market and mutual funds. These options allow investors to diversify their portfolios and manage risk effectively.

Investment Options in Share Market and Mutual Funds

- Share Market: Investors can buy individual stocks of companies listed on the stock exchange, invest in index funds, or trade in exchange-traded funds (ETFs).

- Mutual Funds: Investors can opt for equity mutual funds, debt mutual funds, hybrid funds, or thematic funds, depending on their risk appetite and investment goals.

Portfolio Diversification Examples

- Share Market: Investors can diversify their share market investments by investing in stocks from different sectors such as technology, healthcare, finance, and energy. They can also allocate funds across large-cap, mid-cap, and small-cap stocks to spread risk.

- Mutual Funds: Investors can achieve diversification by investing in different types of mutual funds such as equity, debt, and hybrid funds. They can further diversify within each category by selecting funds with exposure to various industries and asset classes.

Impact of Diversification on Risk Management

Diversification plays a crucial role in managing risk in both the share market and mutual funds. By spreading investments across different asset classes, sectors, and companies, investors can reduce the impact of adverse events on their portfolio. In the share market, diversification helps mitigate company-specific risks, while in mutual funds, it helps balance out market volatility.

Cost Analysis

Investing in the share market and mutual funds comes with various costs that can impact the overall returns on your investment. Let's break down the costs associated with each option and evaluate their cost-effectiveness in the long run.

Costs Associated with Share Market

- Brokerage Fees: Investors in the share market pay brokerage fees for buying and selling stocks. These fees can vary based on the broker and the volume of trades.

- Tax Implications: Capital gains tax is applicable on profits made from selling shares in the share market. The tax rate can vary depending on the holding period.

- Research and Analysis: Investors often need to conduct thorough research and analysis before investing in the share market, which can incur additional costs.

Costs Associated with Mutual Funds

- Management Fees: Mutual funds charge management fees to cover the costs of managing the fund, including research, administration, and marketing.

- Expense Ratios: Mutual funds also have expense ratios that represent the percentage of assets deducted annually to cover operating expenses.

- Load Fees: Some mutual funds charge load fees, which are commissions paid to brokers or salespeople when buying or selling shares.

Comparison of Costs

- Overall, the costs associated with investing in mutual funds tend to be more transparent and predictable compared to the share market.

- While share market investments may have lower expense ratios, the brokerage fees and tax implications can add up, making them less cost-effective in the long run.

- On the other hand, mutual funds might have higher expense ratios but can offer diversification benefits and professional management, potentially justifying the costs.

Summary

In conclusion, the comparison between share market and mutual funds in 2025 reveals a dynamic investment environment where careful consideration of risks, returns, and diversification strategies can lead to informed decision-making for investors seeking financial growth and stability.

FAQs

What are the fundamental differences between share market and mutual funds?

The share market involves buying and selling individual company stocks, while mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities.

How do historical performance and volatility differ between share market and mutual funds?

Historically, the share market tends to have higher returns but also higher volatility compared to mutual funds, which offer more stability due to diversification.

What impact does diversification have on risk management in the share market versus mutual funds?

Diversification in the share market and mutual funds helps mitigate risk by spreading investments across various assets, reducing the impact of a single investment's poor performance.

How do costs associated with investing in the share market compare to mutual funds?

Investing in the share market may involve higher fees, commissions, and expenses compared to mutual funds, which generally have lower costs due to economies of scale from pooling investors' money.