Delving into the comparison of Share market vs. mutual funds: Which is better in 2025?, this introductory segment aims to enthrall and inform the audience, providing a nuanced perspective on the topic.

Subsequently, a detailed explanation will be given regarding the fundamental disparities between share market and mutual funds, shedding light on their distinct characteristics and investment implications.

Comparison of Share Market and Mutual Funds

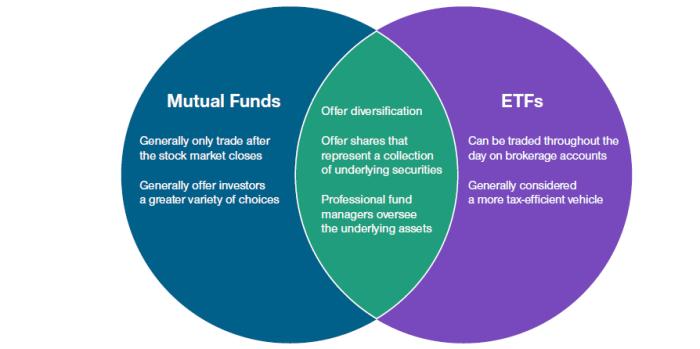

When it comes to investing, two popular options are the share market and mutual funds. While both offer opportunities for growth, they have distinct differences that investors should consider before making a decision.Share Market:

- The share market, also known as the stock market, involves buying and selling individual company shares.

- Investors can directly invest in specific companies by purchasing their shares, which represent ownership in the company.

- Share market investments are more volatile and can yield higher returns, but they also come with higher risks due to market fluctuations.

Mutual Funds:

- Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities.

- Investors in mutual funds own units of the fund rather than individual stocks, providing instant diversification.

- Mutual funds are managed by professional fund managers who make investment decisions based on the fund's objectives and strategy.

- Mutual funds offer investors the benefit of diversification, reducing overall risk compared to investing in individual stocks.

Risk Factors:

Share Market

Investing in the share market carries the risk of losing money due to market volatility, economic conditions, or company-specific factors. Individual stock prices can fluctuate significantly, impacting the overall value of an investor's portfolio.

Mutual Funds

While mutual funds offer diversification, they are still subject to market risks. Factors like interest rate changes, market downturns, or poor fund management can affect the performance of mutual funds.In summary, the share market provides opportunities for higher returns but comes with higher risks, while mutual funds offer diversification and professional management to reduce risk.

Investors should consider their risk tolerance, investment goals, and time horizon when choosing between the share market and mutual funds in 2025.

Performance Analysis in 2025

In 2025, both the share market and mutual funds have shown varying levels of performance, influenced by a multitude of factors. Let's delve into the historical performance and ROI trends of these investment options in the current year.

Historical Performance Comparison

The share market has historically been known for its volatility, with the potential for high returns but also significant risks. On the other hand, mutual funds offer a more diversified approach to investing, spreading out the risk among various securities.

Over the years, both have shown growth, albeit at different rates.

ROI Trends in 2025

In 2025, the share market has experienced fluctuations due to global economic conditions, geopolitical events, and other external factors. The ROI in the share market has been impacted by these uncertainties, leading to both highs and lows throughout the year.

On the contrary, mutual funds have provided a more stable ROI, thanks to their diversified portfolios that help mitigate risks.

Factors Influencing Performance

Several factors influence the performance of both the share market and mutual funds in 2025. Economic indicators, company earnings reports, interest rates, inflation, and geopolitical events all play a significant role in determining the direction of these investments. Additionally, investor sentiment and market sentiment can also sway the performance of both options

Investment Strategies

Investment strategies play a crucial role in determining the success of investments in both the share market and mutual funds. Let's explore the popular strategies and types available in 2025.

Popular Investment Strategies for Share Market Investments

- Diversification: Spreading investments across different sectors and industries to reduce risk.

- Value Investing: Identifying undervalued stocks with the potential for long-term growth.

- Growth Investing: Focusing on companies with high growth potential, even if they have higher valuations.

- Market Timing: Attempting to predict market movements to buy and sell stocks at the most advantageous times.

Different Types of Mutual Funds Available for Investors

- Equity Funds: Investing in stocks of companies to generate capital appreciation.

- Debt Funds: Investing in fixed-income securities like bonds and treasury bills for regular income.

- Index Funds: Mirroring a specific market index to achieve similar returns.

- Hybrid Funds: Combining both equity and debt instruments for balanced returns.

Effectiveness of Short-term and Long-term Investment Strategies

Short-term and long-term investment strategies have different impacts on both the share market and mutual funds.

- Share Market:Short-term strategies like day trading can yield quick profits but come with high risks. Long-term strategies like buy-and-hold can provide stable growth and benefits from compounding.

- Mutual Funds:Short-term strategies may be less effective due to market fluctuations and fund fees. Long-term strategies are generally more successful in mutual funds as they allow for the benefits of diversification and professional management.

Regulatory Environment

In 2025, the regulatory framework governing share market investments plays a crucial role in ensuring transparency, stability, and investor protection. These regulations are designed to maintain market integrity and prevent fraudulent activities.

Regulations Impacting Mutual Funds

- Regulations impact mutual funds by setting guidelines on the types of securities they can invest in, diversification requirements, and disclosure obligations to investors.

- Regulatory bodies such as the Securities and Exchange Board of India (SEBI) closely monitor mutual funds to ensure compliance with investment restrictions and risk management practices.

- Recent regulatory changes have focused on enhancing governance standards, improving disclosure norms, and increasing accountability in the mutual fund industry.

Regulatory Framework for Share Market Investments

- The share market in 2025 is governed by strict regulations that oversee stock exchanges, listed companies, brokers, and investors.

- Regulatory authorities like the Securities and Exchange Board of India (SEBI) and stock exchanges enforce rules related to trading practices, market manipulation, and insider trading to maintain market integrity.

- Recent regulatory changes have aimed at enhancing market surveillance mechanisms, introducing stricter penalties for non-compliance, and promoting investor education and awareness.

Conclusion

Concluding this exploration, the final section will encapsulate the essence of the discussion, encapsulating key points and offering valuable insights to the readers.

FAQ Section

What are the key differences between share market and mutual funds??

The share market involves buying and selling individual company stocks, while mutual funds pool money from multiple investors to invest in a diversified portfolio of assets.

Which typically offers higher returns, share market or mutual funds??

Historically, the share market tends to offer higher returns but comes with higher risks compared to mutual funds.

Are mutual funds better for long-term investments compared to the share market??

Mutual funds are often considered more suitable for long-term investments due to their diversified nature, which helps mitigate risk.