When it comes to investing in dividend-yielding shares in 2025, the landscape is full of opportunities and challenges. Understanding the nuances of this investment strategy can lead to significant returns. From researching dividend histories to building a diversified portfolio, there are key steps to consider.

Let's delve into the world of dividend-yielding shares and explore how you can make the most of your investments in the upcoming year.

Understanding Dividend-Yielding Shares

Dividend-yielding shares are stocks issued by companies that pay out a portion of their profits to shareholders in the form of dividends. These dividends are typically distributed on a regular basis, such as quarterly or annually, providing investors with a steady stream of income.

Investing in dividend-yielding shares can offer several benefits to investors. Firstly, these stocks provide a reliable source of passive income, making them attractive for those seeking regular cash flow. Additionally, dividends can act as a buffer during market downturns, as companies that pay dividends tend to be more stable and profitable.

Comparing Dividend-Yielding Shares to Growth Stocks

When comparing dividend-yielding shares to growth stocks, it's important to consider the investment goals and risk tolerance of the investor. Dividend-yielding shares are generally considered more conservative investments, suitable for those looking for income and stability.

- Dividend-yielding shares offer a consistent income stream through dividends, while growth stocks reinvest profits back into the company for future growth.

- Dividend-yielding shares are typically less volatile than growth stocks, making them a more stable investment option.

- Investors in dividend-yielding shares can benefit from compounding returns over time, as dividends are reinvested to purchase more shares.

Researching Dividend-Yielding Stocks

When investing in dividend-yielding stocks, it is crucial to conduct thorough research to make informed decisions. By identifying key metrics, researching the company's dividend history, and analyzing its financial health, investors can assess the potential returns and risks associated with these stocks.

Key Metrics to Evaluate Dividend-Yielding Stocks

- Dividend Yield: This ratio indicates the percentage of the stock price that is paid out as dividends. A higher dividend yield may signify higher returns, but it is essential to consider sustainability.

- Payout Ratio: This ratio reveals the percentage of earnings that are paid out as dividends. A lower payout ratio indicates that the company has room to grow dividends in the future.

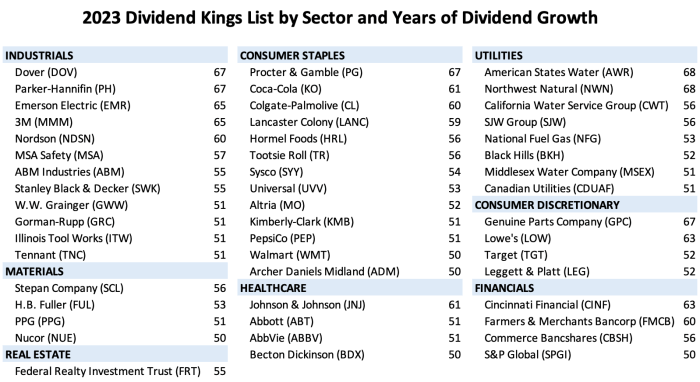

- Dividend Growth Rate: By examining the company's historical dividend growth rate, investors can assess its ability to increase dividends over time.

Researching the Company’s Dividend History

- Reviewing Past Dividend Payments: Analyzing the company's dividend payment history can provide insights into its consistency and commitment to rewarding shareholders.

- Dividend Aristocrats: Companies that have a track record of consistently increasing dividends for at least 25 years are known as Dividend Aristocrats and are often considered reliable investment options.

Importance of Analyzing the Company’s Financial Health

- Revenue and Earnings Growth: Examining the company's revenue and earnings growth trends can help investors gauge its financial stability and potential for future dividend payments.

- Debt Levels: High levels of debt can impact a company's ability to sustain dividend payments during challenging economic conditions. It is essential to assess the company's debt levels and overall financial health.

- Cash Flow: Adequate cash flow is crucial for funding dividend payments. Investors should analyze the company's cash flow position to ensure its ability to maintain or increase dividends.

Building a Diversified Portfolio

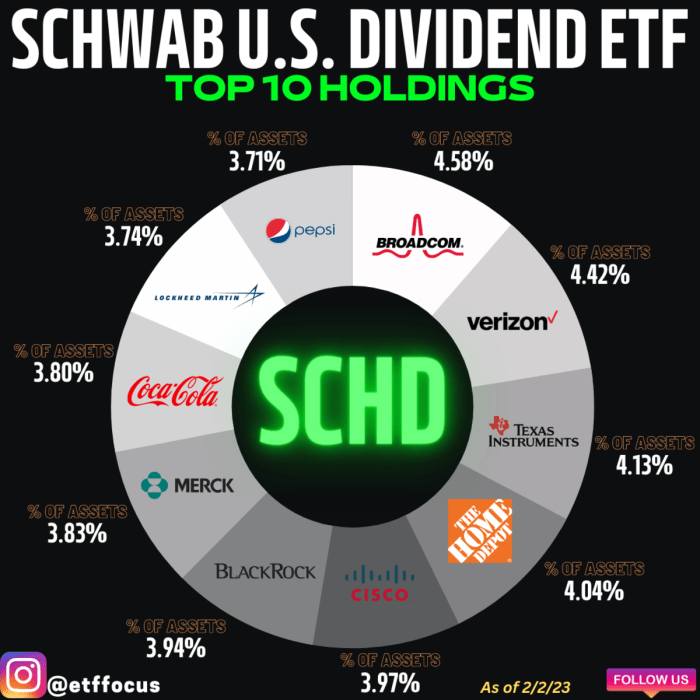

Diversification is a key strategy when investing in dividend-yielding stocks. By spreading your investments across various sectors and industries, you can reduce the risk of being overly exposed to a single economic event or industry-specific downturn.When it comes to sectors that typically offer high dividend-yielding stocks, some examples include:

Real Estate Investment Trusts (REITs)

These companies own and manage income-producing real estate properties and are required to distribute a significant portion of their income to shareholders.

Utilities

Utility companies, such as water, gas, and electric providers, often have stable cash flows and pay attractive dividends.

Consumer Staples

Companies that produce essential goods like food, beverages, and household products tend to have stable earnings and consistent dividend payouts.

Reinvesting Dividends to Enhance Returns

Reinvesting dividends is a powerful strategy to enhance returns over time. Instead of taking the cash payouts, you can use them to purchase more shares of the same stock or other dividend-yielding stocks. This compound effect can significantly boost your overall returns, especially when practiced consistently over the long term.

- By reinvesting dividends, you can benefit from the power of compounding, where your reinvested dividends generate additional dividends in the future.

- Over time, this can lead to a substantial increase in the total value of your investment, as you continually reinvest and accumulate more shares.

- Many brokerage platforms offer automatic dividend reinvestment plans (DRIPs) that allow you to reinvest your dividends without incurring additional transaction fees.

Investing Strategies for 2025

In the ever-changing landscape of the stock market, it's crucial to adapt your investment strategies to the current economic trends. Let's delve into how these trends may impact dividend-yielding shares in 2025 and explore the best practices for investing in such stocks.

Impact of Economic Trends on Dividend-Yielding Shares

Economic trends play a significant role in shaping the performance of dividend-yielding shares. In 2025, factors such as GDP growth, inflation rates, and global trade dynamics can influence the overall market sentiment towards dividend stocks. Investors should keep a close eye on these trends to make informed decisions.

Impact of Interest Rates on Dividend-Yielding Stocks

Interest rates have a direct impact on the attractiveness of dividend-yielding stocks. When interest rates are low, dividend stocks become more appealing to investors seeking income generation. Conversely, rising interest rates may lead investors to shift towards other investment options, affecting the demand for dividend-yielding shares.

Best Practices for Investing in Dividend-Yielding Shares

- Focus on companies with a consistent track record of dividend payments and growth.

- Conduct thorough research on the company's financial health, dividend payout ratio, and future growth prospects.

- Diversify your portfolio across various sectors to mitigate risks and enhance potential returns.

- Monitor the market conditions and economic indicators to adjust your investment strategy accordingly.

- Consider reinvesting dividends to benefit from compounding returns over time.

Last Point

As we conclude our discussion on how to invest in dividend-yielding shares in 2025, it's clear that this investment avenue offers a promising path for those looking to grow their wealth. By following the strategies Artikeld and staying informed about market trends, you can navigate the world of dividend-yielding stocks with confidence and build a portfolio that stands the test of time.

Top FAQs

What are dividend-yielding shares?

Dividend-yielding shares are stocks of companies that distribute a portion of their profits to shareholders in the form of dividends.

Why is diversification important in a dividend-yielding stock portfolio?

Diversification helps spread risk across different investments, reducing the impact of any single stock's performance on the overall portfolio.

How do economic trends affect dividend-yielding shares in 2025?

Economic trends can impact the performance of dividend-yielding shares, as companies may adjust their dividend policies based on economic conditions.