Starting with Automotive Insurance Quote Trends in Saudi Arabia – What’s Changing?, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

The following paragraphs provide descriptive and clear information about the topic at hand.

Overview of Automotive Insurance in Saudi Arabia

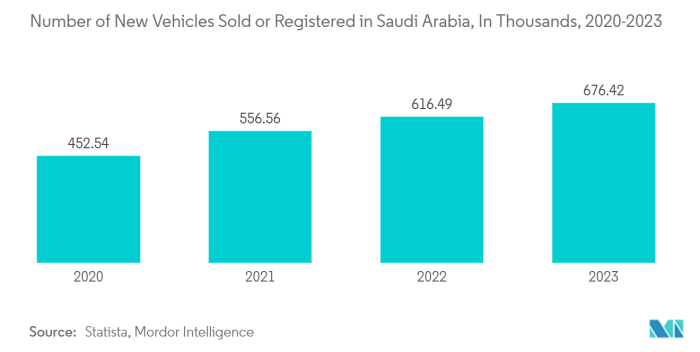

Automotive insurance in Saudi Arabia plays a crucial role in ensuring financial protection for vehicle owners in case of accidents or damages. It is mandatory for all vehicles to have insurance coverage in the country, making it a significant aspect of vehicle ownership.

Current Landscape of Automotive Insurance

The automotive insurance market in Saudi Arabia is dominated by both local and international insurance companies. These companies offer a wide range of insurance products tailored to meet the needs of vehicle owners in the country. The market is competitive, with insurers constantly striving to provide better coverage options and services to attract customers.

Key Players in the Automotive Insurance Industry

- Saudi Arabian Cooperative Insurance Company

- Tawuniya

- AXA Cooperative Insurance

- Allianz Saudi Fransi Cooperative Insurance Company

These are some of the prominent players in the automotive insurance industry in Saudi Arabia, offering comprehensive insurance solutions to vehicle owners.

Importance of Automotive Insurance for Vehicle Owners

Automotive insurance is essential for vehicle owners in Saudi Arabia as it provides financial protection against unforeseen events such as accidents, theft, or damages. Having insurance coverage not only ensures compliance with the law but also provides peace of mind knowing that any potential financial losses resulting from accidents are covered.

Factors Influencing Automotive Insurance Quotes

When it comes to determining automotive insurance quotes in Saudi Arabia, there are several key factors that play a significant role in the calculation of premiums. These factors can vary based on individual circumstances and can greatly impact the cost of insurance coverage.

Vehicle Type, Age, and Usage

The type of vehicle you drive, its age, and how it is used all have a direct impact on the insurance quotes you receive. Generally, newer and more expensive vehicles will have higher insurance premiums due to the increased cost of repairs or replacements.

Similarly, vehicles that are used for commercial purposes or have a high annual mileage may also result in higher premiums.

- More luxurious or high-performance vehicles tend to have higher insurance premiums compared to standard vehicles.

- Older vehicles may have lower premiums due to their decreased value, but this can vary depending on the specific make and model.

- Vehicles used for business purposes may be subject to higher premiums due to increased risk exposure.

Driving History and Location

Your driving history and the location where you reside or primarily drive can also impact your insurance premiums. Insurance companies take into account your past driving record, including any accidents or traffic violations, to assess the level of risk you pose as a driver.

Additionally, the area where you live can influence premiums, with urban areas typically associated with higher rates due to increased traffic and crime rates.

- A clean driving record with no accidents or violations can result in lower insurance premiums as it indicates a lower risk of future claims.

- Living in a rural area with less traffic congestion and lower crime rates may lead to lower insurance premiums compared to urban areas.

Technology Trends in Automotive Insurance

Technology is revolutionizing the automotive insurance sector in Saudi Arabia, bringing about significant changes in the way insurance companies operate and offer services. From innovative tech solutions to the use of telematics and IoT, here's a closer look at how technology is shaping the future of automotive insurance in the Kingdom.

Innovative Tech Solutions by Insurance Companies

- Insurance companies in Saudi Arabia are increasingly leveraging artificial intelligence (AI) and machine learning algorithms to streamline processes such as claims processing and underwriting.

- Some insurers are implementing blockchain technology to enhance data security and prevent fraud in the insurance industry.

- Mobile apps are being developed by insurance providers to offer customers a seamless experience, allowing them to manage policies, file claims, and access assistance on-the-go.

Impact of Telematics and IoT on Automotive Insurance Pricing

- Telematics devices installed in vehicles collect real-time data on driving behavior, such as speed, braking patterns, and mileage. This data is used by insurers to offer personalized insurance plans based on individual driving habits.

- IoT-enabled features in vehicles, such as sensors and connectivity systems, enable insurers to assess risks more accurately and adjust premiums accordingly. For example, vehicles equipped with anti-theft devices or automatic emergency braking systems may qualify for discounts on insurance premiums.

- By incorporating telematics and IoT technologies, insurance companies are able to promote safer driving practices among policyholders, leading to reduced accidents and claims, ultimately benefiting both insurers and customers.

Regulatory Environment and Policy Changes

The regulatory environment and policy changes play a crucial role in shaping the automotive insurance landscape in Saudi Arabia. Let's delve into recent developments and how they impact insurance pricing and coverage.

Recent Regulatory Developments

- One of the recent regulatory changes in Saudi Arabia is the introduction of mandatory vehicle insurance. This has increased the demand for insurance policies and subsequently affected the pricing strategies of insurance providers.

- The Saudi Arabian Monetary Authority (SAMA) has implemented stricter regulations to ensure the financial stability of insurance companies, which in turn influences the pricing of automotive insurance.

Policy Influence on Pricing and Coverage

- Changes in policies, such as the introduction of new coverage requirements or adjustments in claim procedures, can directly impact insurance pricing. For example, an increase in coverage mandates may lead to higher premiums for policyholders.

- Policy changes also affect the coverage options available to consumers. For instance, the implementation of more comprehensive insurance packages may provide better protection but at a higher cost.

Upcoming Regulations

- Looking ahead, upcoming regulations in Saudi Arabia may focus on enhancing consumer protection, promoting fair competition among insurance providers, and addressing emerging risks in the automotive sector.

- There is a possibility of new regulations that aim to standardize insurance practices and improve transparency in the industry, which could have a significant impact on how automotive insurance is priced and offered to customers.

End of Discussion

Concluding the discussion with a summary and final thoughts presented in an engaging manner.

Frequently Asked Questions

What are some factors that affect automotive insurance quotes in Saudi Arabia?

Factors such as vehicle type, age, usage, driving history, and location play a significant role in determining insurance quotes.

How is technology influencing the automotive insurance sector in Saudi Arabia?

Technology is revolutionizing the industry with innovative solutions like telematics and IoT, impacting pricing and coverage.

What recent regulatory developments have influenced automotive insurance in Saudi Arabia?

Changes in policies and regulations can directly impact insurance pricing and coverage, with upcoming regulations also playing a role.